When a Tax Consultant Is Better Than DIY Software: The 2026 Decision Guide

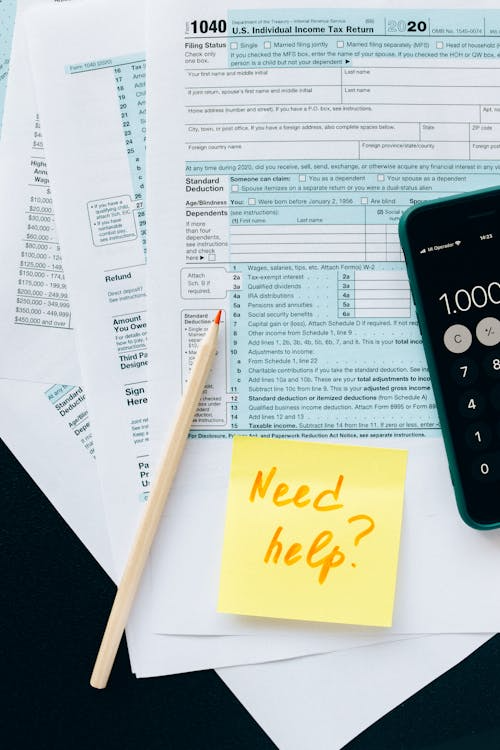

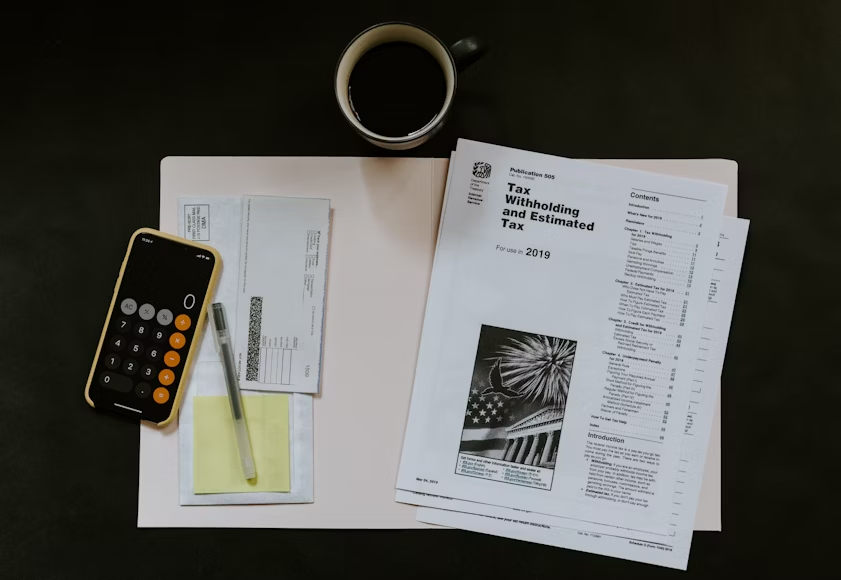

Tax software has come a long way. For simple filings, it can feel fast, affordable, and reassuringly automated. But as 2026 approaches, many business owners are realizing that convenience doesn’t always equal clarity. Between evolving tax regulations, increased IRS scrutiny, and more complex business structures, there’s a growing gap between what DIY tools can handle and […]

When a Tax Consultant Is Better Than DIY Software: The 2026 Decision Guide Read More »