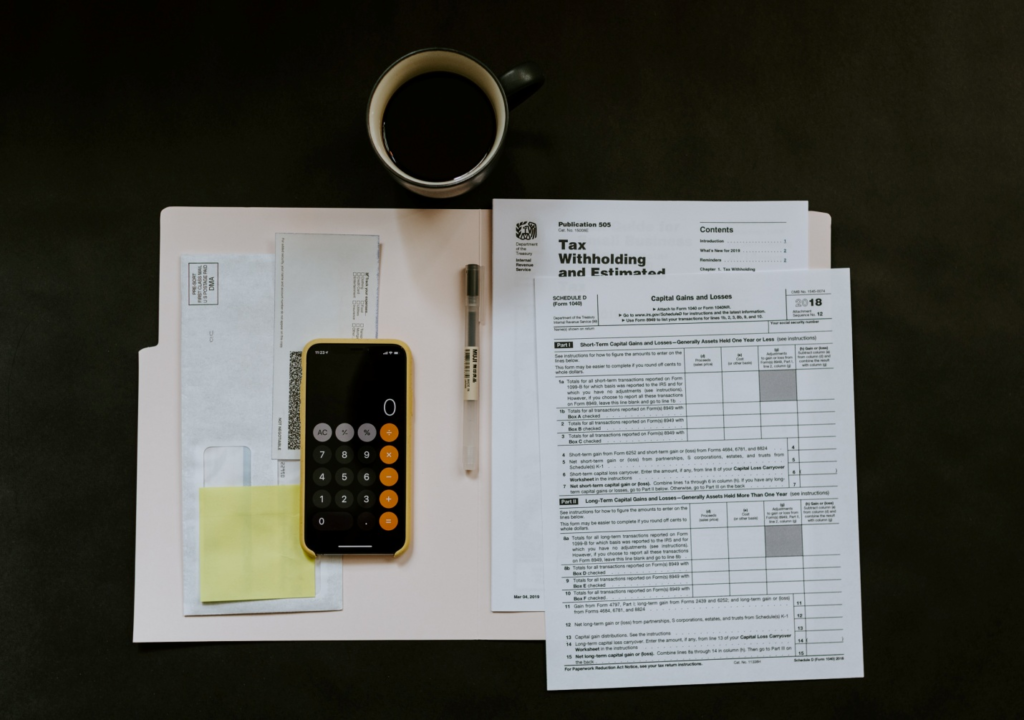

Filing taxes can be daunting as a teenager or young adult. However, It’s essential to have a grasp of taxation and how it applies to your situation. This blog will provide some helpful tax tips for teenagers and young adults.

…

Home » Blogs

Filing taxes can be daunting as a teenager or young adult. However, It’s essential to have a grasp of taxation and how it applies to your situation. This blog will provide some helpful tax tips for teenagers and young adults.

…

Tax is an inevitable part of life. Whether we like it or not, we all have to pay it. However, understanding the complex world of taxes can be daunting, and many of us are left in the dark when it comes to how much we should be paying, what our tax dollars are being used for, and how we can reduce our tax burden.

…

Taxes can be a significant expense for businesses that can eat away at their profits. However, with proper planning and strategizing, businesses can reduce their tax liabilities and save money. This blog will explore some effective strategies businesses can use to save taxes while understanding the importance of comprehending their tax liabilities.

…

Small businesses play a vital role in the economy, but they often face significant challenges when it comes to financial planning.

…

How Tax Planning Can Help Your Small Business ThriveRead More »

Do you feel like you’re drowning in debt? Are you struggling to keep up with your bills and payments? You’re not alone. According to the Bank Rate, the average American has over $96,371 in personal debt, including credit cards, loans, and mortgages. That’s a heavy burden to carry, both financially and emotionally.

…

A 3-Step Guide On Managing Your Debt; Tips From a Certified Tax PlannerRead More »

Business Bankruptcy is more common nowadays due to the ever-changing economic statuses worldwide. Every year, big and small businesses file for bankruptcy for several reasons. In each of the years from 2016 through 2020, more than 22,000 firms declared bankruptcy, according to statistics from the U.S. Courts. This figure does not include the number of small enterprises that simply shut their doors and leave their failing operations.

…

Although it’s a common misconception that tax accountants’ main role is managing client tax concerns, they do far more. They offer guidance on matters that could have an impact on your productivity.

…

What Services Should A Business Tax Accountant Offer You?Read More »

Tax planning should be a key component of a financial management strategy for any business. Businesses may apply efficient tax planning methods to maximize their tax situation and achieve long-term profitability. Tax planning examines a company’s financial situation to identify the best ways to lower its tax burden while adhering to all applicable rules and regulations.

Here are a few benefits of effective tax planning for small businesses:

A company may manage its cash flow more effectively with effective tax planning. Businesses can devote more money to crucial operational costs or expansion prospects by lowering their tax liabilities. This can also help a company take advantage of early payment incentives or make on-time payments to suppliers and vendors.

Tax planning necessitates a thorough understanding of tax rules and regulations. As a result, it may help businesses comply with tax laws and avoid costly fines and penalties.

Lowering a business’s tax liability is one of the tax planning process’ most evident advantages. Tax planning may considerably lower the amount of tax a business pays by identifying the possible credits, deductions, and exemptions to which the firm is entitled. This can free up additional funds for business investments or other necessary needs.

Profitability may rise for a company if tax liabilities are reduced, and cash flow is improved. Businesses may develop and diversify if they have more money to spend in the company or payout to shareholders, which will ultimately increase their profitability. According to a study by the National Small Business Association, taxes are the most significant regulatory burden for small businesses, with 85% of respondents citing them as a challenge.

Tax planning may aid companies in maintaining a competitive position in their particular industries by lowering tax liabilities and boosting profitability. Businesses may recruit and keep top personnel and provide customers with more affordable prices when they have more money to invest in the company and pay staff.

Risk management for a firm is another benefit of tax planning. Tax planning may assist a firm in taking preventative measures to avoid prospective complications by examining its tax status and identifying potential concerns or areas of risk.

Businesses may manage their finances more easily with the help of good tax planning. Businesses may take advantage of opportunities as they present themselves, invest in development, and respond to shifting market conditions by lowering tax liabilities and enhancing cash flow.

Effective tax planning is essential for businesses to minimize tax liabilities, improve cash flow, and enhance profitability. Collaborating with skilled tax specialists at Nidhi Jain can maximize tax status and ensure long-term financial success. As a personal tax accountant, international tax advisor, and international tax accountant in San Francisco, we offer various tax and accounting services, including tax planning consultancy, business tax services, individual tax filing, and tax resolution services. With experienced accountants in San Francisco and San Jose, California, our team provides Back Tax Solutions and personal tax filing services. As certified public accountants in the USA, we can help businesses comply with regulations and reduce tax risks. Contact us today to learn how their tax planning services can benefit your business.

Auditing mistakes can be very costly and affect your business badly. According to a study, the incidents of occupational fraud resulted in a median loss of $140,000. Of these situations, more than a quarter resulted in losses of at least $1 million. Auditors need to avoid mistakes that can lead to inaccuracies or missed fraud that could later cause businesses a big setback. Here we will explore 5 common mistakes to avoid in auditing to ensure that audits add value to the business rather than causing more losses.

…

One of the major challenges in running a small business is managing your cash flow. Cash flow problems account for 82% of the businesses that shut down.

Improving your cash flow requires your back-office accounting to be efficient and error-free. Organizing your business’ accounting and bookkeeping can take up a big chunk of your time, but it’s something you can’t ignore.

…

5 Bookkeeping & Accounting Tips for Small BusinessesRead More »

It’s important to ensure you file your tax return accurately and honestly in order to avoid triggering an audit.

…

While some businesses prefer handling payroll tasks in-house through manual bookkeeping, others wisely opt for the expertise of a professional payroll services provider.

…

Why You Should Consider Outsourcing Payroll ServicesRead More »

Tax planning is a way to minimize your tax liabilities. There are many allowances, exemptions, deductions, and exclusions in taxes that can reduce the amount a person or a business owes to the state. Tax planning, done with the help of a professional, is completely legal and compliant with IRS standards.

…

The Importance of Tax Planning for Corporates and IndividualsRead More »

When you outsource accounting, you don’t have to worry about recruiting, employee benefits, insurance, on boarding, or any other variables that may drive up operational cost.

…

Why You Should Consider Outsourcing Accounting ServicesRead More »

People often use the terms finance and accounting interchangeably, but there are key differences between both.

Both finance and accounting are related to the management and administration of a company’s assets. However, both have different focuses. Keep reading this blog to learn the key differences between finance and accounting.

…