Scaling a startup is exciting, but with growth comes increased tax responsibility. Many business owners don’t realize how quickly tax obligations can expand alongside revenue and operations. Without proper planning, what starts as a manageable tax situation can evolve into a financial strain. Early-stage tax planning for startups helps limit long-term stress and keeps your business financially healthy.

Understand How Business Structure Affects Tax Obligations

One of the first areas to review is your business entity. A sole proprietorship, partnership, or LLC might be sufficient when your company is small, but as revenue increases, the default tax treatment may no longer serve your goals. Certain businesses benefit from making an S-Corp election to save on self-employment taxes and potentially lower overall tax burdens. However, the structure needs to align with your income, type of work, and long-term plans. A qualified tax consultant can help you understand the pros and cons of switching structures.

Keep Bookkeeping Accurate and Timely

Poor bookkeeping practices often lead to tax issues during periods of fast growth. When income, expenses, and deductions aren’t recorded properly, you risk filing inaccurate returns or missing key deductions. As the number of transactions increases, so does the potential for errors. Business owners should adopt reliable systems early and review financial data monthly or quarterly. Using professional bookkeeping support ensures the records are ready for analysis and strategic tax adjustments.

Account for Tax Impacts When Hiring or Expanding

As you expand operations, hire staff, or open new locations, the tax impact can be significant. Hiring employees, for example, can trigger new federal and state tax requirements. Expanding into other states may subject your business to sales tax collection and income tax reporting in those jurisdictions. Understanding where your business has tax obligations is critical to avoid penalties and fees. Each operational change should be reviewed from a tax standpoint before it’s executed.

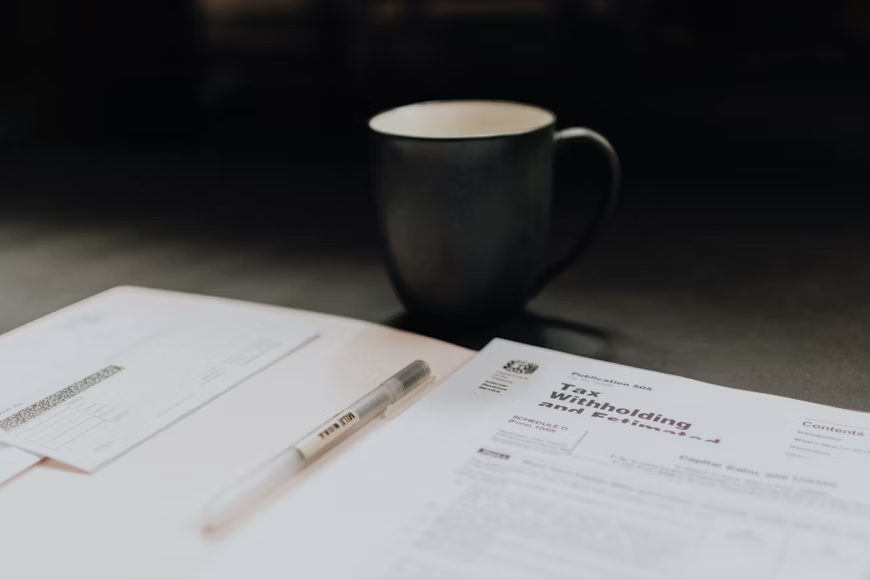

Don’t Wait to Plan for Quarterly and Annual Tax Payments

A growing business usually means bigger quarterly tax payments. Underpaying estimated taxes often results in penalties, and overpaying limits cash flow. Projecting quarterly obligations based on current earnings ensures your business stays ahead. Annual planning is just as important. If your business had a profitable year, consider timing large purchases, making retirement contributions, or adjusting distributions to lower taxable income before year-end. Strategic timing can make a measurable difference.

Grow Smart with Focused Tax Planning

Scaling doesn’t have to come with financial surprises. When business owners prioritize quarterly financial reviews, maintain solid bookkeeping practices, and get guidance from a qualified tax consultant, they’re better positioned to manage tax growth confidently. Staying proactive instead of reactive gives you better control over your tax outcomes.

For more insights on tax planning for startups, bookkeeping practices, and quarterly financial reviews, read the blog at Nidhi Jain CPA.