Consultants often focus on billable hours, client delivery, and growth opportunities — but the quiet work happening behind the scenes matters just as much. In 2026, small bookkeeping mistakes are no longer harmless oversights. They can directly impact profitability, tax accuracy, and long-term planning. What looks minor month to month can quietly erode financial clarity over time.

At Nidhi Jain CPA, we see how bookkeeping issues compound — especially for consultants managing multiple clients, projects, and income streams.

Small Errors Create Big Profitability Gaps

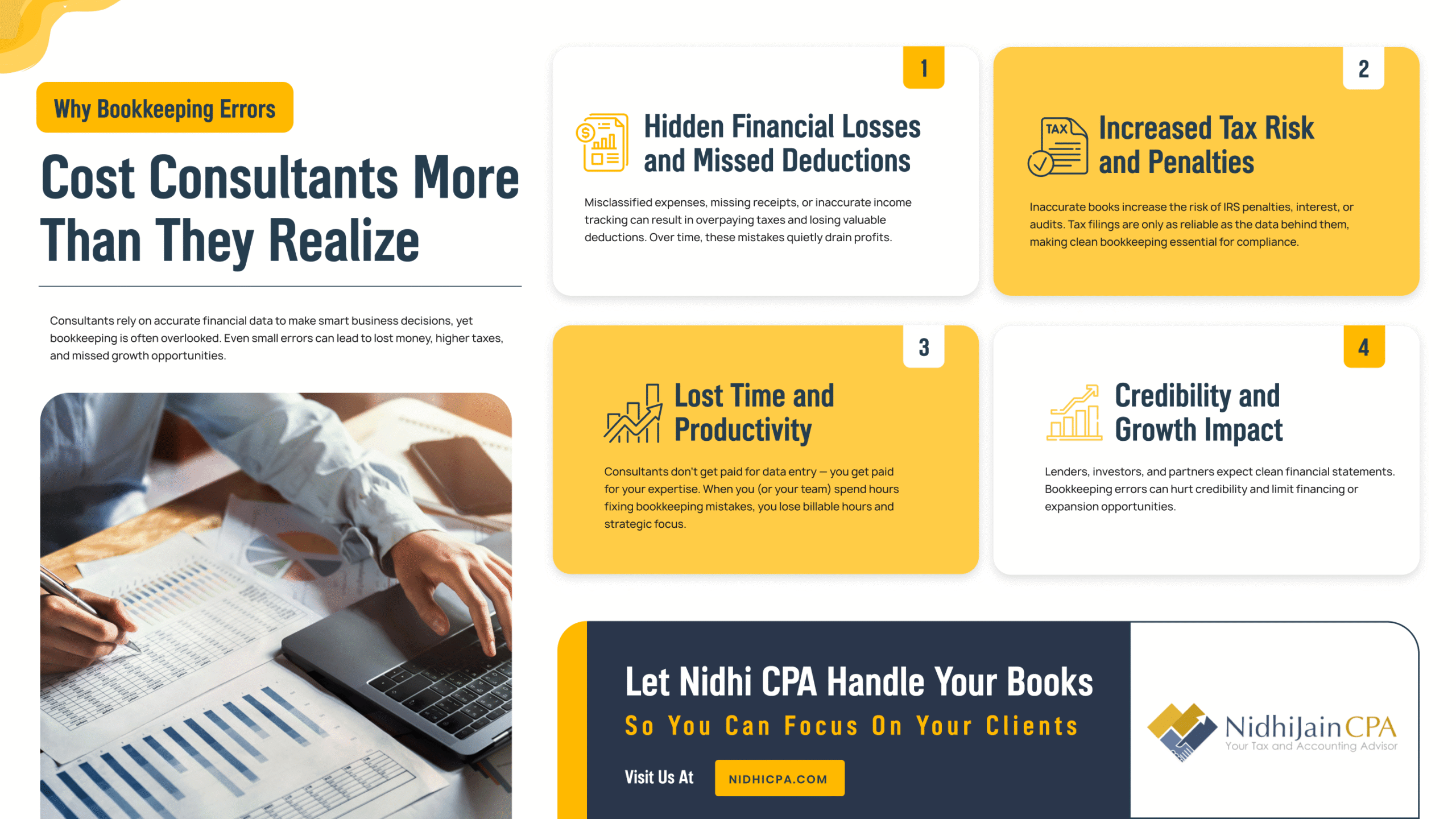

Misclassified expenses, missed deductions, or delayed reconciliations may not feel urgent, but they distort the true picture of profitability. When income and expenses aren’t tracked accurately, consultants often underestimate costs or overestimate margins.

This leads to pricing decisions based on incomplete data. Over time, underpricing services or overlooking rising expenses can significantly reduce net income. Clean, structured bookkeeping services provide the insight needed to price confidently and protect margins.

Filing Accuracy Depends on the Books

Tax filings are only as accurate as the records behind them. Inconsistent bookkeeping increases the risk of reporting errors, income mismatches, or unsupported deductions — all of which draw unnecessary attention.

In 2026, improved data matching means discrepancies are flagged faster and more frequently. Strong tax and accounting services rely on accurate books to ensure filings reflect reality, not assumptions.

Working with a certified public accountant helps ensure that bookkeeping and tax reporting stay aligned year-round — not just at filing time.

Poor Records Limit Tax Planning Opportunities

Effective tax planning services depend on timing, structure, and clarity. When bookkeeping is incomplete or delayed, planning becomes reactive instead of strategic.

Consultants with clean, up-to-date records can make informed decisions about expense timing, income recognition, and future investments. Those without reliable books often miss legitimate opportunities to reduce tax liability simply because the data isn’t there.

Bookkeeping isn’t just recordkeeping — it’s the foundation of smarter tax decisions.

Errors Increase Audit and Penalty Risk

Many audit triggers start with bookkeeping problems. Rounded numbers, inconsistent categories, or unexplained swings in income raise questions quickly. Even when nothing improper occurred, poor documentation makes it harder to respond confidently.

A proactive tax advisor helps identify and correct issues before they become compliance risks. Clear records reduce stress, shorten response time, and improve outcomes if questions arise.

Long-Term Planning Suffers Without Clarity

Consultants often think about bookkeeping as a short-term task, but its biggest impact is long-term. Inaccurate records make it difficult to forecast cash flow, plan for growth, or prepare for transitions.

Reliable Bay Area bookkeeping support allows consultants to plan ahead with confidence — whether that means scaling services, adjusting workloads, or preparing for future financial goals.

Turning Bookkeeping Into a Strategic Advantage

Bookkeeping doesn’t have to be a pain point. When done correctly, it becomes a decision-making tool that supports profitability, compliance, and planning.

At Nidhi Jain CPA, we help consultants transform bookkeeping from a source of risk into a source of clarity — supporting smarter tax planning and stronger financial outcomes.

Small bookkeeping errors don’t stay small for long.

Nidhi Jain CPA provides bookkeeping and tax planning support for consultants in San Francisco, San Jose, and across the Bay Area — and beyond. Contact us to bring clarity, accuracy, and strategy back to your financial records.