-

Nidhi Jain

Related Blogs

For many business owners, tax season is often reduced to a last-minute scramble to submit returns on time. While compliance is essential, focusing solely on filing overlooks the significant advantages of year-round planning. Businesses that integrate continuous tax planning services with accurate recordkeeping and forecasting gain stronger financial stability, maximize deductions, and minimize liabilities. A qualified consultant provides guidance beyond filing, helping companies anticipate challenges, align payments with cash flow, and implement strategies that support sustainable growth. …

When Business Tax Planning Matters More Than Filing the ReturnRead More »

Accurate financial records are the cornerstone of effective tax planning. Businesses that fail to maintain clean books often face flawed projections, mismanaged deductions, and heightened audit risk. Maintaining proper bookkeeping guarantees that income, expenses, and assets are correctly tracked, allowing a tax consultant to develop precise strategies and reduce compliance exposure. Companies that integrate reliable bookkeeping with professional guidance from a CPA gain clarity, confidence, and the ability to make informed tax decisions year-round. …

Why Clean Books Are the Foundation of Smart Tax DecisionsRead More »

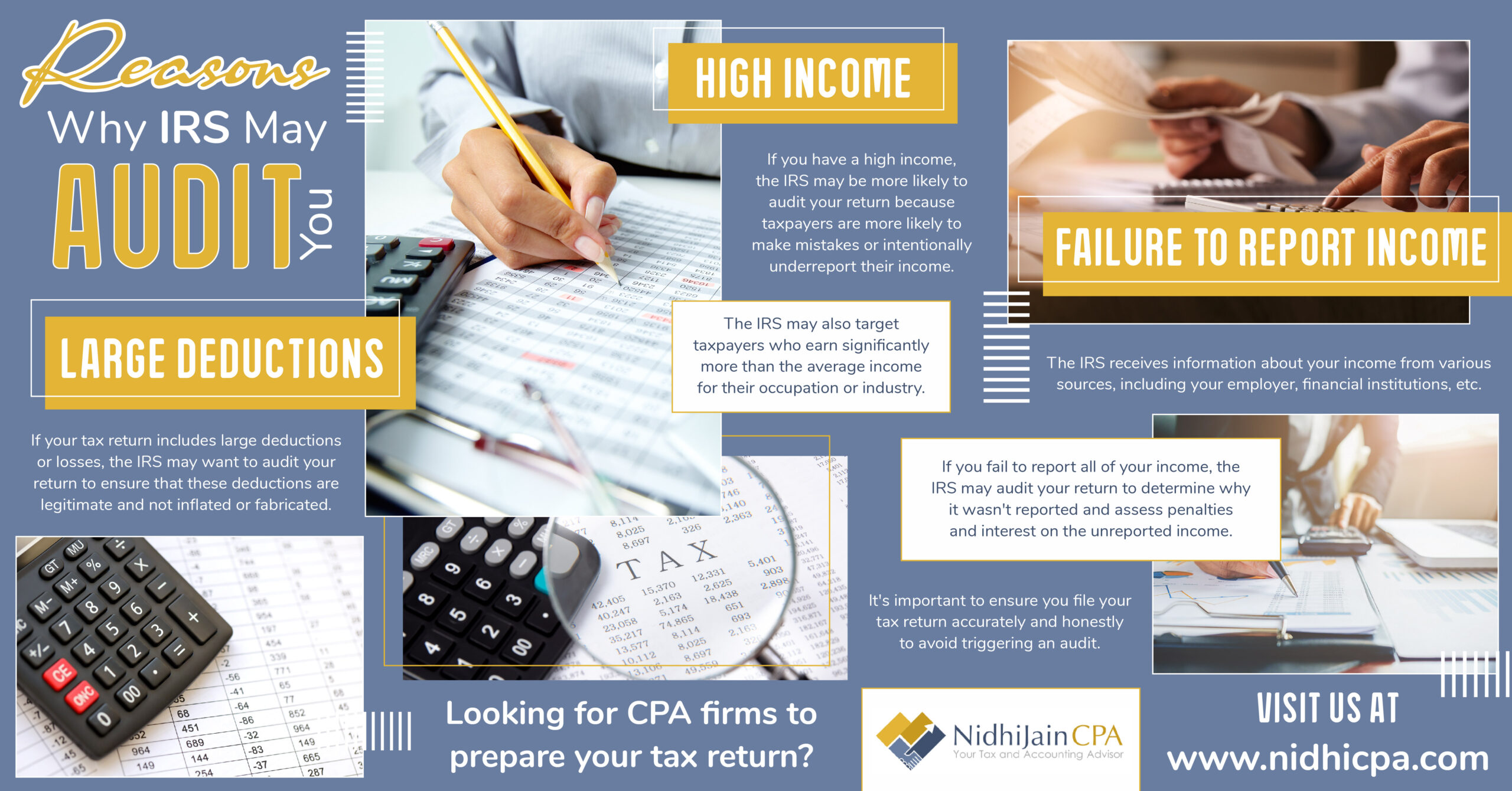

Business deductions reduce taxable income, but they also attract scrutiny when records lack clarity or consistency. The IRS increasingly relies on data matching and automated reviews to flag expense categories that frequently contain errors or unsupported claims. Businesses that understand which expenses receive closer review and how to document them correctly reduce audit risk and strengthen tax outcomes. Working with a qualified tax consultant guarantees deductions remain defensible, accurate, and aligned with compliance standards. …

Business Expenses the IRS Reviews Most Closely TodayRead More »