In the early stages of building a business, many founders handle everything themselves—marketing, operations, customer service, and even bookkeeping. This hands-on approach may work for a while, but there often comes a point when doing it all can cause more harm than good. Recognizing that moment early can prevent financial mistakes and free up time to focus on growth.

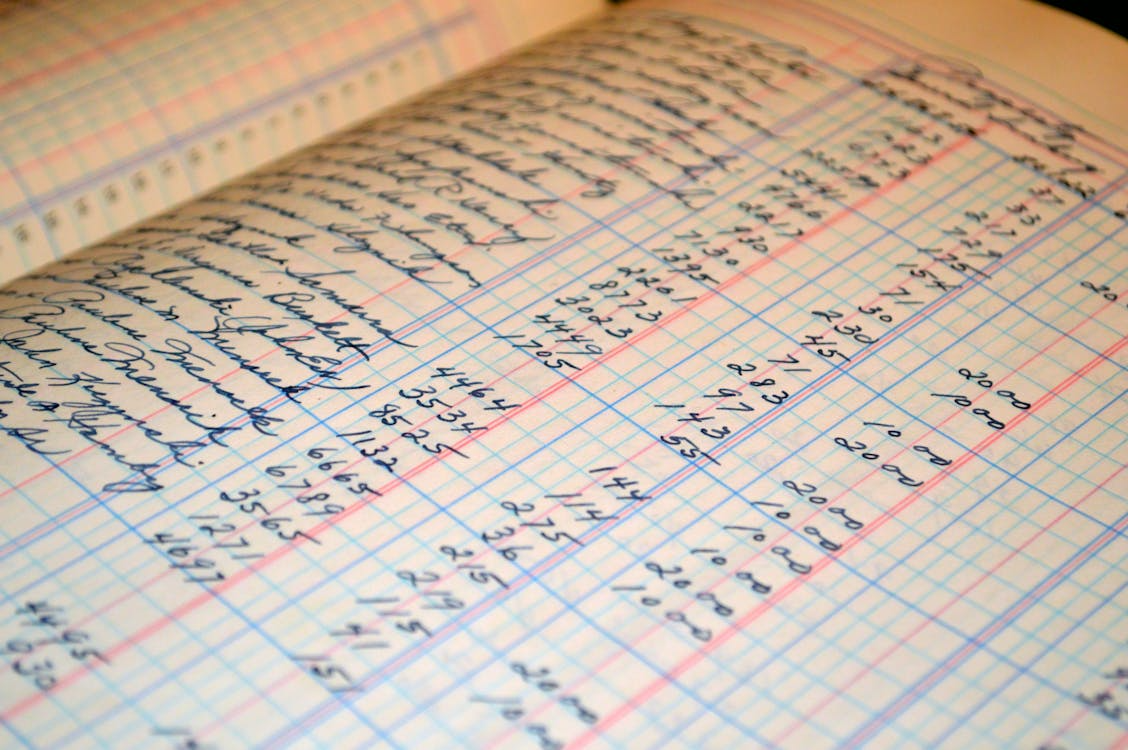

Your Books Are Always Behind

When financial records consistently fall behind, that’s a clear warning sign. A founder’s time is limited, and managing bookkeeping during off-hours or weekends leads to inconsistent tracking. Delays in updating records can result in missed deductions, late tax filings, or inaccurate budgeting. Business owners who struggle to reconcile accounts each month, categorize expenses properly, or keep up with quarterly filings may benefit from hiring a professional. Staying current is key, especially when preparing for tax deadlines or making decisions based on real-time data.

You’re Unsure About Compliance Rules

As a business grows, so do the requirements. Sales tax, 1099 filings, and estimated tax payments aren’t always straightforward. For founders without a financial background, compliance becomes a guessing game, increasing the risk of errors. A tax consultant or bookkeeper can ensure records align with local and federal regulations, reducing the chance of audits or penalties. Instead of spending hours researching rules, it often makes more sense to rely on someone who already knows them.

It’s Affecting Business Decisions

Good financial records help with decision-making. When books are disorganized or outdated, it’s harder to know whether the business is actually profitable. Founders may overestimate cash flow, underprice services, or miss opportunities due to a lack of clarity. Professional bookkeeping services organize income and expenses consistently, providing a reliable base for evaluating performance, forecasting revenue, and tracking growth. When your data isn’t helping you make better choices, it’s time to hand it off.

Tax Season Is Always Stressful

Many founders wait until the end of the year to sort through receipts and transactions. This leads to long weekends of financial catch-up, uncertainty about deductions, and high stress levels. A bookkeeper keeps everything ready year-round. With organized records, tax planning becomes simpler, and any CPA or tax consultant working with those records will be able to complete filings more efficiently. If tax time feels overwhelming every year, bringing in professional help is a smart move.

You Want to Focus on Strategy, Not Admin

Managing your own books takes time and mental energy. As your business grows, that time may be better spent working on new services, improving customer experience, or scaling operations. Founders often reach a point where doing their own bookkeeping means less focus on higher-value work. That tradeoff starts to impact growth. When you’re spending too much time in spreadsheets instead of steering your business, it’s worth considering professional help.

Knowing When to Let Go

Bookkeeping is important, but it doesn’t need to be done by the founder forever. Falling behind on records, struggling with compliance, and lacking visibility into business performance are all signs it’s time to consider outsourcing. Bringing in an experienced bookkeeper not only helps clean up your financials, but it also makes future tax planning easier and more accurate. If you’re unsure whether it’s time to step back from the books, it probably is.

For more tips on bookkeeping, tax planning, and how to make smarter decisions as a founder, visit the blog at Nidhi Jain CPA.