An IRS audit doesn’t always mean something went wrong, but it does require immediate clarity. Businesses with clean, well-maintained books are far better equipped to respond quickly and accurately. Disorganized financials not only delay the process but can also trigger deeper reviews, penalties, or adjustments. While no one wants to think about audits, preparing for them throughout the year is a smart business practice. …

Blogs

Home » Blogs

Poor Records Can Cost You Money

If you’re running a business, keeping track of your financial records isn’t optional—it’s a legal requirement. Inaccurate or missing documentation can lead to missed deductions, IRS penalties, and even audits. That’s why record-keeping for business taxes should be one of your top financial priorities. …

The Importance of Accurate Record-Keeping for Business TaxesRead More »

Common Tax Errors Businesses Often Make

Business taxes can be complicated. However, many of the mistakes that lead to penalties or IRS audits are preventable. If you’re a business owner, it’s important to avoid business tax traps that could derail your operations or reduce your profits. …

Tax Mistakes Can Cost More Than You Think

As an entrepreneur, you’re managing growth, handling operations, and making key decisions daily. But one overlooked area—your taxes—can quickly lead to big setbacks. Filing late, missing deductions or misunderstanding tax law can result in heavy penalties. That’s where a tax consultant for entrepreneurs becomes essential. …

Why Every Entrepreneur Needs a Trusted Tax ConsultantRead More »

Stay Ahead with Tax Rule Changes

As a business owner, keeping up with tax regulations is part of staying financially secure. Whether you’re a small startup or a growing company, navigating tax changes for businesses helps you stay compliant and make informed decisions. Federal and state governments regularly revise tax codes, impacting deductions, credits, reporting rules, and filing deadlines. Adapting to these updates protects your profits and avoids penalties. …

Navigating Tax Changes: What Every Business Owner Needs to KnowRead More »

When you’re running a business, you’re constantly looking for ways to grow, reinvest, and increase profitability. One of the smartest, most often overlooked tools to support that growth is a tax strategy for business growth. Rather than treating taxes as a burden, forward-thinking companies treat them as a powerful opportunity to streamline operations, retain earnings, and plan for the future. …

How the Right Tax Strategy Can Propel Your Business GrowthRead More »

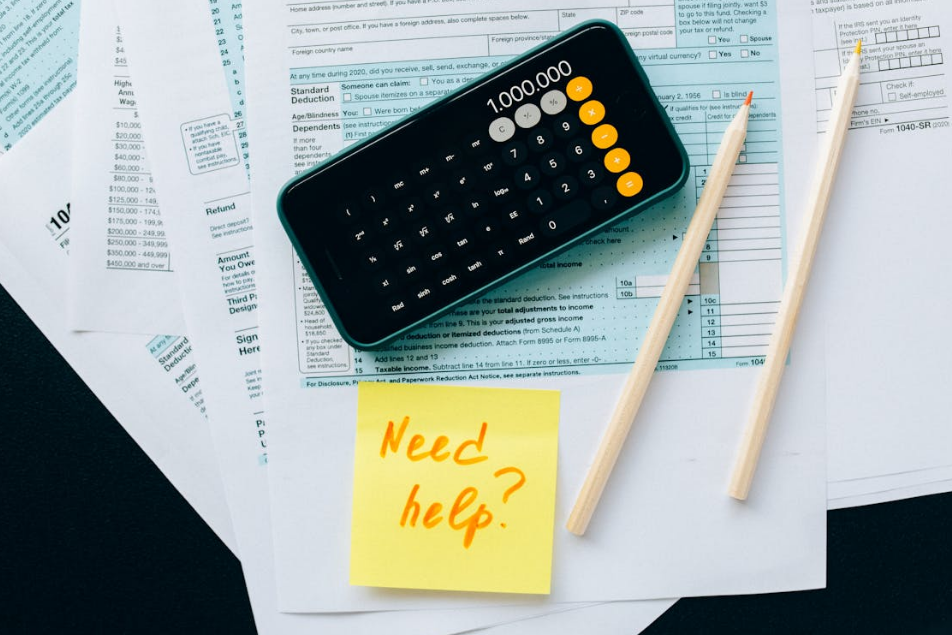

Tax season can be stressful, but making mistakes on your tax return can be even more costly. To keep more money on your pocket, watch out for these common tax errors. …

Choosing between an LLC and an S-Corp can significantly impact how much you pay in taxes. While both structures offer liability protection and tax advantages, they differ in how earnings are taxed, deductions are applied, and profits are distributed. Understanding these differences is essential for business owners looking to optimize their tax savings. …

LLC vs. S-Corp: Which Business Structure Saves You More on Taxes?Read More »

Tax season can be stressful, and errors in your return can lead to costly penalties or missed deductions. Whether you’re managing business tax filing or handling your personal taxes, certain common mistakes could impact your finances. By understanding these pitfalls, you can take steps to ensure a smoother filing process and maximize your savings. …

Running a small business comes with many financial responsibilities, and taxes can be one of the most significant expenses. However, with the right small business tax strategies, you can legally minimize your tax burden and keep more of your hard-earned profits. Understanding essential deductions, tax credits, and proactive planning can make a big difference in managing your finances effectively. …

Tax-Saving Strategies Every Small Business Owner Should KnowRead More »

As the end of the year approaches, businesses have a crucial opportunity to implement year-end tax planning strategies that maximize deductions and improve financial efficiency. Proper preparation can make a significant difference in reducing taxable income and positioning a business for a strong start in the new year. By working with a tax consultant in San Francisco and maintaining accurate bookkeeping and accounting, business owners can take advantage of available deductions before the tax deadline. …

Year-End Tax Planning Tips to Maximize DeductionsRead More »

Facing tax issues with the IRS can be stressful and overwhelming, whether it’s an audit, unpaid taxes, or a dispute over deductions. The complexities of tax laws and regulations make it difficult to handle these problems alone. This is where a CPA plays a crucial role in IRS problem resolution, offering guidance, expertise, and strategies to address tax challenges effectively. …

Each year, the IRS adjust tax brackets, deductions, and credits to account for inflation. In 2025, these changes could impact how much you owe or save on taxes. Find out below how you can be prepared for the IRS’s 2025 tax adjustments. …

Are You Prepared for the IRS’s 2025 Tax Adjustments?Read More »

The standard deduction is getting a nice bump in 2025, and that means more money in your pocket! For individual taxpayers, this change could be a game-changer when it comes to tax time. The good news is that this increase in the standard deduction 2025 will help reduce your taxable income, but how can you maximize this benefit? Let’s dive in! …

Maximizing Benefits from the Increased Standard Deduction in 2025Read More »