Withholding tax refers to the income tax your employer pays to the Internal Revenue Service (IRS) after withholding it from your income. If your employer withholds too much during the year, you will be eligible for a tax refund.

On the other hand, if your employer withholds too little, then you might owe IRS the remaining amount of the tax.

Who will pay the withholding tax?

Most employees need to pay the withholding tax. However, your employer has the burden of sending this tax to the IRS.

If you want to exempt yourself from the withholding tax, then you must have no federal income tax owed in the last year, while you’re also not expected to owe any of the federal income tax in the current year.

Understanding the withholding tax

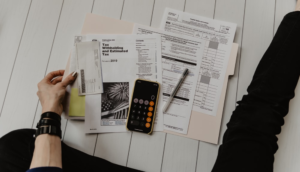

To determine the amount that is withheld from your income, you’ll need to fill out Form W-4 and provide it to the employer when your job starts. The W-4 includes the following information:

- The person’s filing status (i.e., you’re married, single, etc.)

- The person’s income

- Whether the employer withholds any additional amount on your behalf

Note: if your status is “married” and is filing jointly with your spouse, then you’ll probably have a lower amount of money withheld in taxes by your employer.

Estimated tax vs. withholding tax: what’s the difference?

Estimated taxes aren’t paid by your employer. Instead, they’re paid by those who earn their income that’s not subject to a withholding tax. For instance, a person who is self-employed might be required to estimate the total tax liability and make quarterly payments to the IRS.

If you want to file a tax refund for your withholding taxes, we can help you. At Nidhi Jain CPA we offer professional personal and business tax filing services. Our certified accountants ensure that your taxes are accurately filed to avoid any issues with the IRS.

We also offer strategic tax solutions that ensure your business taxes are kept to a minimum, while your tax returns are maximized.

Our team also has certified public accountants in USA to help you with payroll accounting, bookkeeping, personal tax filing and much more.

Call us or email us now to learn more about our accounting services.