For consultants in San Jose juggling multiple income sources, staying tax-ready in Q3 requires more than just timely filings. The third quarter is a crucial checkpoint for reviewing your financial standing, updating estimates, and preparing for the year-end. Whether you’re managing 1099 income, project-based work, or small business operations, organized tax planning can prevent penalties and support smarter decisions.

Recalculate Estimated Tax Payments

By Q3, your year-to-date income provides a reliable base for refining your estimated tax payments. Consultants earning income from multiple clients often face fluctuations that make early-year estimates outdated. Instead of relying on Q1 or Q2 projections, update your income and deductions to recalculate your tax liability. This ensures your Q3 estimated payment reflects your actual financial situation, avoiding underpayment penalties from the IRS. Using this quarter to get your numbers right gives you one more opportunity to course-correct before the end of the year.

Separate Business and Personal Expenses

Many independent consultants still mix personal and business transactions, especially when running lean operations. In Q3, take the time to separate these expenses and ensure you’re maintaining clean records. This not only simplifies bookkeeping practices but also strengthens your documentation in case of an IRS review. Create or maintain dedicated business bank accounts and credit cards, and review all transactions monthly. Clarity now prevents confusion later and provides a clear audit trail to support deductions.

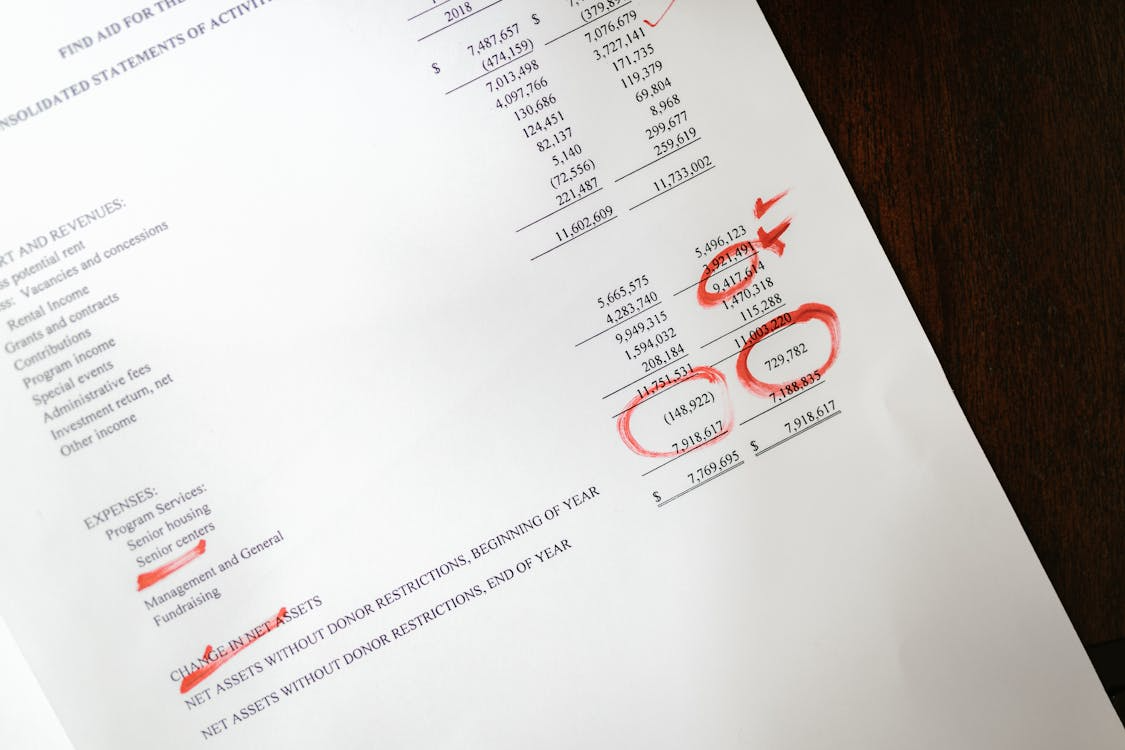

Review Quarterly Financial Reports

Q3 is an ideal time to evaluate quarterly financial reviews for patterns and potential changes. Look at your revenue, expenses, and net income trends across the first three quarters. Are you consistently exceeding revenue targets? Are expenses creeping up in certain categories? Identifying these trends helps consultants make better tax decisions, like adjusting estimated payments or timing major business purchases for deductions. These reviews also support smarter financial forecasting as you prepare for Q4 and the following year.

Organize Contractor and Vendor Payments

Consultants often work with subcontractors or freelancers for support on client projects. If you’ve paid any individual $600 or more this year, you’ll likely need to issue them a 1099-NEC. Q3 is a smart time to collect W-9 forms and ensure your records are up to date. Waiting until January slows down the process and increases the chances of missed filings. Start organizing your contractor data now to streamline your year-end reporting.

Update Bookkeeping to Reflect Tax Categories

As income grows and projects multiply, it’s common for consultants to expand their expense categories without updating their bookkeeping practices. Q3 is the right time to review your chart of accounts and ensure each category aligns with IRS-acceptable deductions. Clean, tax-aligned bookkeeping now saves time and stress when it’s time to prepare returns. Avoid vague labels and overuse of “miscellaneous” by reviewing accounts monthly or working with a tax consultant to refine your system.

Staying Focused on Tax Planning in Q3

Q3 offers consultants a focused window to improve bookkeeping practices, track quarterly financial reviews, and make smarter tax planning decisions. Avoid year-end bottlenecks by using this time to organize, evaluate, and update. Staying prepared now gives you flexibility later and ensures fewer surprises during filing season.

For more practical guidance on quarterly business strategies and tax readines in San Jose, visit the blog at Nidhi Jain CPA for updated tips and insights.