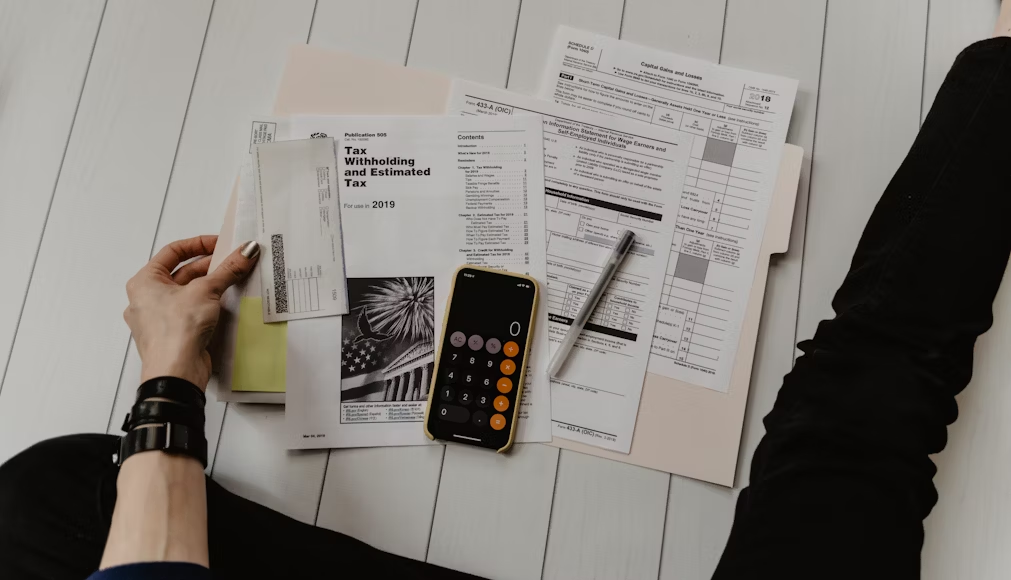

For freelancers, the start of January often brings unnecessary stress. Instead of entering the new year ready to focus on work, many self-employed professionals find themselves buried in receipts, invoices, and tax documents. A more efficient approach is to use the final months of the year to take control of tax planning for freelancers. Preparing early not only saves time but also minimizes errors and maximizes deductions.

Track Income Regularly and Accurately

Start by reviewing all income sources from the year. Freelancers often have multiple streams—project-based work, retainer clients, and even one-off gigs. Make sure each transaction is recorded accurately in a spreadsheet or accounting software. It’s also a good time to verify that all bank transfers, payments through platforms like PayPal or Stripe, and direct deposits are included. Waiting until January increases the risk of forgetting small but taxable payments. Early tracking also allows time to correct any inconsistencies before the filing season begins.

Gather and Organize Receipts Before They Pile Up

Receipts form the backbone of legitimate deductions. Expenses related to office supplies, software subscriptions, marketing, and even business meals can add up significantly. Freelancers should not rely on memory to recall these details later. It’s best to collect, categorize, and label receipts now. Whether stored physically in folders or digitally in a cloud drive or expense app, keeping them sorted by category ensures faster access later. Regular receipt reviews also help flag any charges that may be personal and should not be claimed.

Review Deductions with Extra Attention

Tax-deductible expenses for freelancers often go overlooked. These might include a portion of home office costs, utilities, mileage for business travel, education or training, and more. Year-end is the right time to evaluate what qualifies and what doesn’t. Comparing this year’s deductions with last year’s returns can help identify missing entries. This review process should also consider whether any large purchases should be made before December 31 to count as business expenses for the current tax year. The goal is to take every allowed deduction without risking over-reporting.

Set Aside Time for Quarterly Financial Reviews

Don’t wait until the year ends to assess performance. Schedule a quarterly financial review in late November or early December. This review should compare expected income with actual revenue, highlight patterns in spending, and determine if estimated tax payments are still accurate. These reviews help freelancers adjust their budgets and tax withholdings while there’s still time. It also provides insight into whether additional contributions to a SEP IRA or other retirement accounts are a smart move before year-end.

Recheck Bookkeeping Practices for Accuracy

Now is a smart time to revisit your bookkeeping practices. Are entries consistent across categories? Are all bank and credit card statements reconciled? Errors or missing information can delay tax filing and cause issues later. Using software is helpful, but manual reviews should still be part of the process. Good bookkeeping now helps reduce the time spent fixing problems later, especially during the busy tax season.

Where to Learn More

Waiting until January to organize your records can lead to unnecessary pressure, missed deductions, or even penalties. Freelancers who use December to sort income records, receipts, and bookkeeping practices are better prepared to take advantage of early filing. A quarterly financial review can also improve how you plan for the upcoming year, especially for anyone focusing on tax planning for freelancers.

For more practical tips, tax insights, and small business strategies, read the blog at Nidhi Jain CPA.