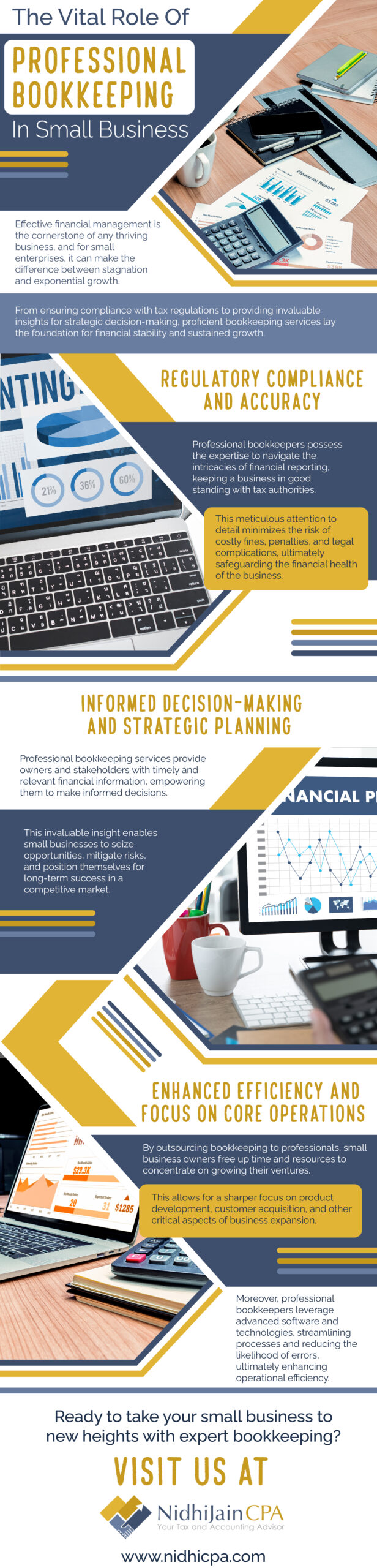

Effective financial management is the cornerstone of any thriving business, and for small enterprises, it can make the difference between stagnation and exponential growth.

From ensuring compliance with tax regulations to providing invaluable insights for strategic decision-making, proficient bookkeeping services lay the foundation for financial stability and sustained growth.