Poor Records Can Cost You Money

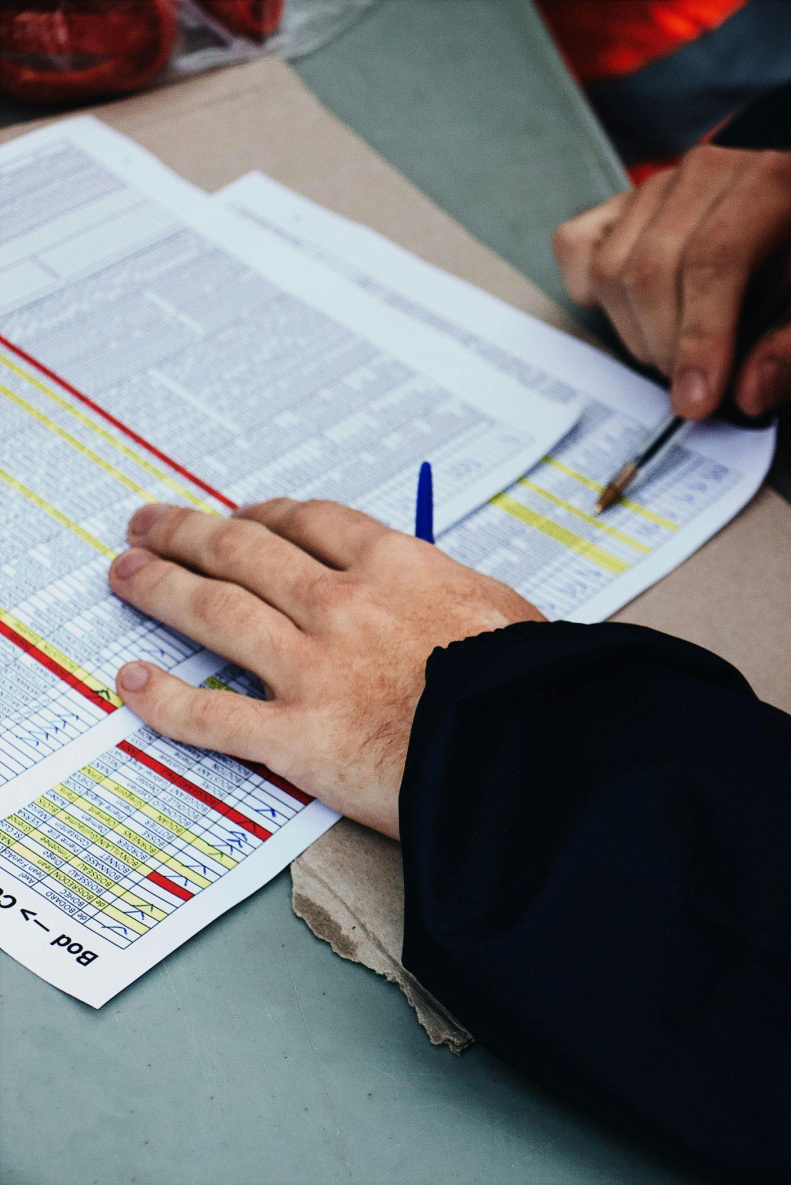

If you’re running a business, keeping track of your financial records isn’t optional—it’s a legal requirement. Inaccurate or missing documentation can lead to missed deductions, IRS penalties, and even audits. That’s why record-keeping for business taxes should be one of your top financial priorities.

The IRS requires businesses to keep records of income, expenses, payroll, and more. Without proper documentation, you risk filing errors that could delay returns or result in fines. A strong record-keeping system supports clean reporting and gives you a clear picture of your business’s financial health.

Good Records Mean Smoother Tax Filing

The smoother your records, the easier your tax season becomes. With organized receipts, invoices, bank statements, and payroll documents, you’re less likely to miss anything important during filing. A trusted tax accountant will appreciate having complete, up-to-date files to work with—saving both time and money.

Whether you’re filing quarterly or annually, clear records speed up the process and reduce errors. This helps you take full advantage of deductions while complying with IRS rules. If you’re managing employees or contractors, clean documentation is also vital for reporting payroll accurately.

Record-Keeping Supports Long-Term Tax Strategy

Solid records don’t just make tax filing easier—they help you plan. Whether you work with a personal tax accountant or a team that handles bookkeeping and accounting, up-to-date records support better tax planning and forecasting.

For instance, understanding your year-round spending and earnings can help your CPA recommend when to defer income, accelerate expenses, or invest in equipment to reduce your tax liability. A long-term view gives you more control over your business finances.

Record-keeping also helps when it’s time to file individual tax documents or seek back tax solutions if you’ve fallen behind. Professionals offering tax planning or business tax services rely on this data to help with deductions, credits, and long-term strategies.

Stay Audit-Ready and Stress-Free

One of the biggest benefits of accurate record-keeping for business taxes is audit readiness. Audits are rare but not impossible. If the IRS ever audits you, clean records can protect you from penalties and provide peace of mind.

Even if you work with an international tax accountant or need support from tax resolution services, organized records can make all the difference. Professionals can respond faster and more effectively when everything is well-documented.

Stay Smart with Nidhi Jain CPA’s Expert Support

Smart Record-Keeping Starts Here — Nidhi Jain CPA Can Help

Accurate records save you time, reduce stress, and protect your business. Whether you’re working with tax and accounting or filing through business tax filing, having clean and complete records matters. Nidhi Jain CPA works with businesses across California, offering support through tax planning, tax planning consultant services, and more. Stay ahead of IRS issues and make smarter financial decisions.

Want more advice like this? Read our informative blog at Nidhi Jain CPA for helpful tips and tax insights.