-

Nidhi Jain

Related Blogs

Many business owners fear underpaying their taxes and facing penalties. But what if you’re actually overpaying? While it may seem safer to overestimate, consistently paying more than necessary drains your working capital and limits how you can invest in your business. Accurate San Jose tax planning helps you strike the right balance, staying compliant without sacrificing cash flow. …

How To Know If You’re Overpaying in Estimated TaxesRead More »

Quarter three is a turning point in the tax year. For individuals and businesses alike, it’s an ideal time to assess what’s working and fix what isn’t. But far too often, taxpayers miss this chance, leading to rushed filings, missed deductions, and unexpected liabilities. Smart tax planning isn’t just for April. By working with a qualified tax consultant, businesses can reduce costly mistakes and improve their financial readiness before Q4 begins. …

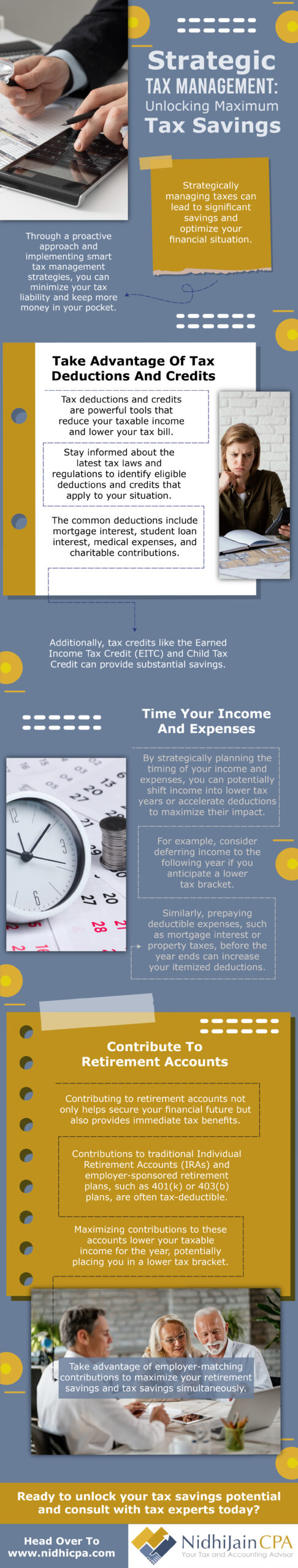

Strategic tax planning involves making informed financial decisions throughout the year to legally minimize your tax burden and increase overall savings. …

Strategic Tax Planning: Your Path to Financial SuccessRead More »