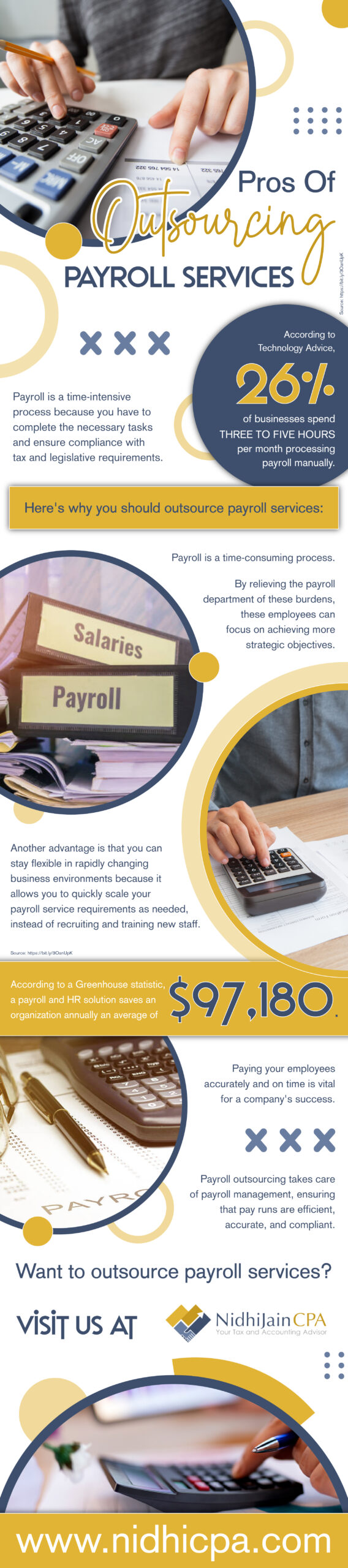

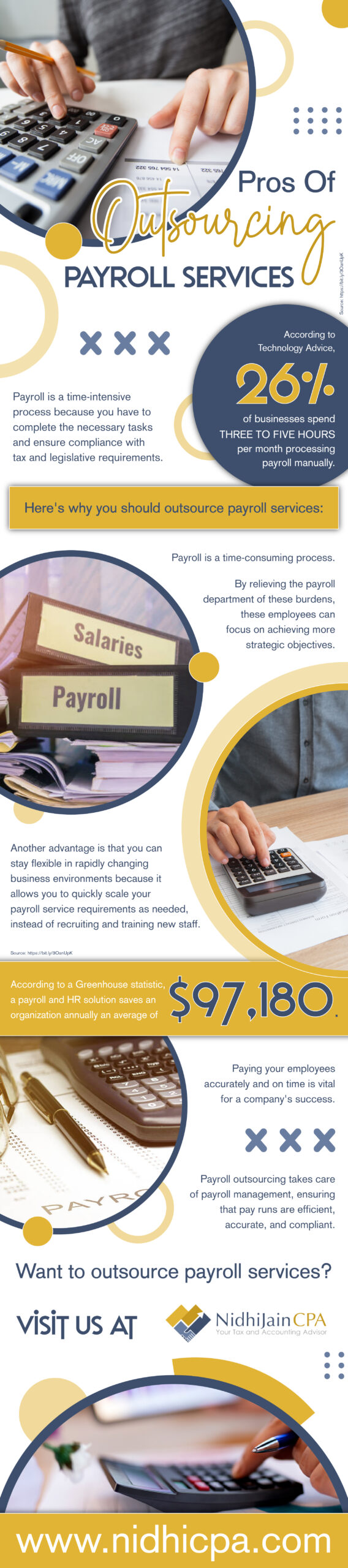

Payroll is a time-intensive process because you have to complete the necessary tasks and ensure compliance with tax and legislative requirements.

Payroll is a time-intensive process because you have to complete the necessary tasks and ensure compliance with tax and legislative requirements.

For freelancers and gig professionals, taxes often feel confusing, unpredictable, and stressful — especially when quarterly payments enter the picture. Unlike traditional employees, gig earners don’t have taxes withheld automatically, which means staying compliant requires planning, calculation, and discipline. The good news is that quarterly taxes don’t have to be overwhelming when approached correctly. …

Quarterly Taxes for Gig Professionals: A Simple Breakdown That Actually WorksRead More »

Consultants often focus on billable hours, client delivery, and growth opportunities — but the quiet work happening behind the scenes matters just as much. In 2026, small bookkeeping mistakes are no longer harmless oversights. They can directly impact profitability, tax accuracy, and long-term planning. What looks minor month to month can quietly erode financial clarity over time. …

Why Bookkeeping Errors Cost Consultants More Than They RealizeRead More »

The IRS is entering 2026 with sharper tools, better data matching, and a clearer focus on compliance gaps that technology alone can’t explain away. While audits are still relatively rare overall, the likelihood increases significantly when certain patterns appear in a return. Understanding the new audit triggers allows professionals and business owners to reduce exposure before issues arise. …

The New Audit Triggers: What the IRS Will Flag Most in 2026Read More »