-

Nidhi Jain

Related Blogs

Bookkeeping often stays unnoticed until deadlines approach, creating pressure and increasing the risk of errors or compliance issues. A proactive and structured approach keeps records accurate, reduces risk, and ensures financial clarity at all times. …

Your financial goals, income, and life circumstances are unique, and your tax strategy should reflect that. A personalized, proactive approach helps you plan beyond tax season, adapt as your goals change, and make confident financial decisions year-round. …

Why Your Tax Strategy Should Be As Unique As Your Financial GoalsRead More »

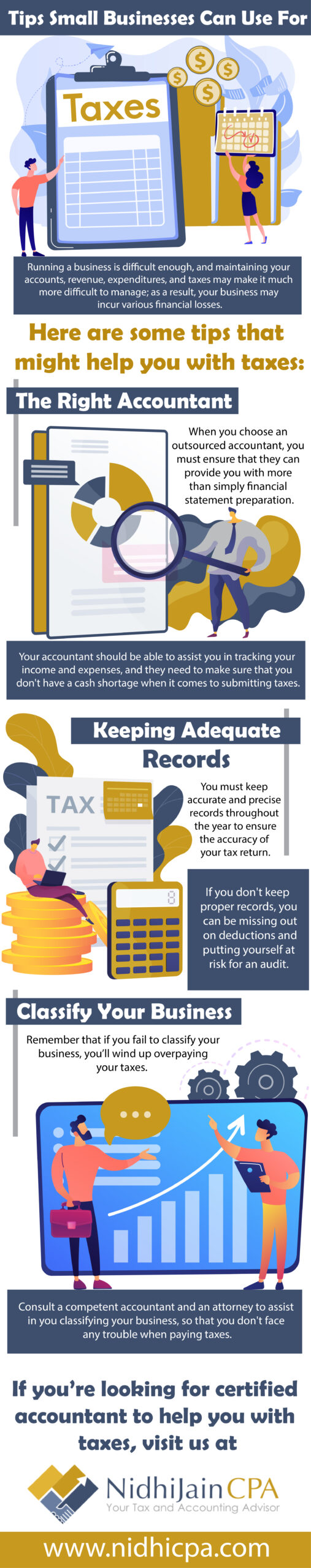

For many business owners, tax season is often reduced to a last-minute scramble to submit returns on time. While compliance is essential, focusing solely on filing overlooks the significant advantages of year-round planning. Businesses that integrate continuous tax planning services with accurate recordkeeping and forecasting gain stronger financial stability, maximize deductions, and minimize liabilities. A qualified consultant provides guidance beyond filing, helping companies anticipate challenges, align payments with cash flow, and implement strategies that support sustainable growth. …

When Business Tax Planning Matters More Than Filing the ReturnRead More »